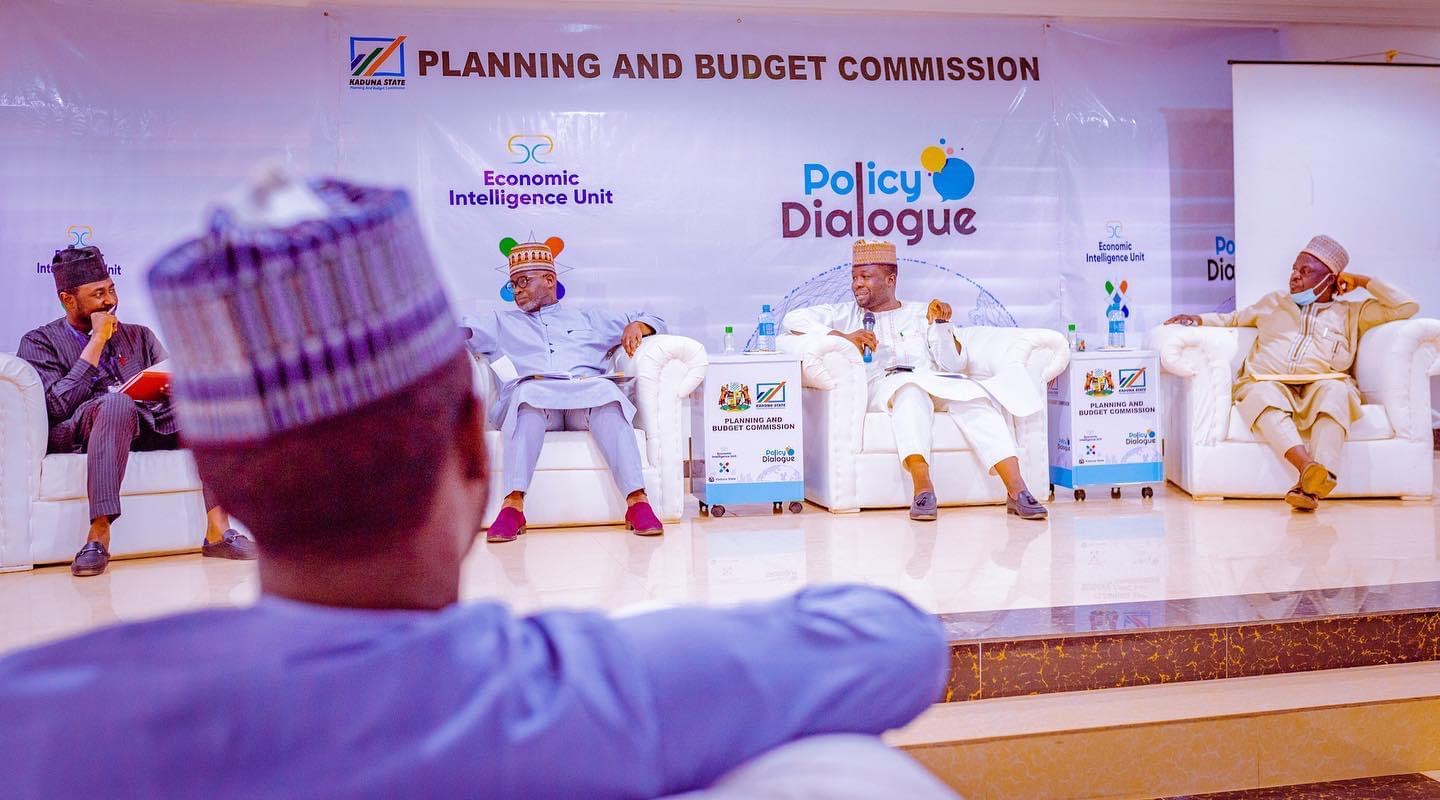

TAKEAWAY FROM THE PLANNING AND BUDGET COMMISSION: POLICY DIALOGUE SESSION; THE PERSPECTIVE AND CONTRIBUTION OF ZAID ABUBAKAR Ph.D ON VALUE ADDED TAX (VAT)!!!

The Executive Chairman of Kaduna State Internal Revenue Service, KADIRS, Dr. Zaid Abubakar observed that when one look at the horizontal allocation Formula of VAT which has parameters for allocations, Decentralization of VAT according to states will not be too realistic.

He stressed that there is something wrong with the law of the VAT, which needed to be addressed for the heated debate over VAT be tamed.

According to him,”If you look through the horizontal allocation formula, you will see that there are parameters that are used for the allocations. Population, Equity and Derivation. There is no way if we bring Decentralizing system of VAT, Lagos will take fertile share than kaduna state, because of the population of some of these states are having

if you revert the sharing formula, what we have today is, Equity takes 50%, Population takes 30% and Derivation takes 20%. Now if you have performance base on Derivation and population, not by equity, if you are to revert the parameters and say okay, Derivation been the major parameter here should take 50% and population should take 30% and Equity takes 20%, all these clamour won’t be there because state with the highest number of residents will take a larger chunk due to the fact that they have More transaction taking place in the state, and stand to derive more revenue”.

“Now if you allocate 50% of whatever is been collected as Derivation strength, to state like Kano been the Largest states interms of population will take the highest chunk, Possibly followed by lagos then Kaduna, let’s take it in that order, then the clamour I think will go away, because in some case when you follow up the debate tends to take some political dimension, but we can address it through addressing these parameters especially the percentage allocation, the only way we get it right or going forward”.

He explained that the only way to get it right or going forward is to look at the Central account system, thereby reintroducing the Branch still and State code.

“So you need to introduce Branch-still alongside State code, that’s the only way you will be able to aggregate and isolate collection by each state and also account for Derivation. So I think changing the sharing formula will address the Clamour”.

Signed:

Zakari, Jamilu Muhammad.

Head: Corporate Communication.

30th December, 2021.